Age of Heroes 4 by www.racek.wgz.cz.jar, (225.95kB)

Age of Heroes 4 by www.racek.wgz.cz.jar, (225.95kB) Age of Heroes 4

Assassins Creed CZ

Brick Breaker Revolution

Call of duty 4: Modern warfare

Crazy Campus CZ

Hummer Jump and Race

Juiced 2 3D

Minigolf Revolution: Pirate Park

My Model Train

Oblivion mobile

Port royale 2

Real Rugby 2007 2D

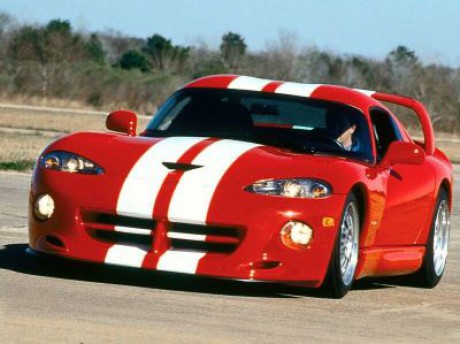

Street Race Wold 3D

The Simpsons: Minutes to Meltdown

Komentáře

Přehled komentářů

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(Lamaeving, 2. 2. 2024 8:49)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

(Lamaeving, 2. 2. 2024 8:20)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaeving, 2. 2. 2024 2:24)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaeving, 2. 2. 2024 0:15)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

(Lamaeving, 1. 2. 2024 23:51)

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

HOT INSIDE UNCENSORED

(dydaychig, 1. 2. 2024 12:55)

Welcome, everyone ready for a deep dive into real events impacting each of us. Our channel offers unique uncensored videos. Join us and discover the truth!

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/Hot_Inside

How kamikaze drones destroy machinery and buildings

(dydaychig, 1. 2. 2024 12:27)

Greetings, truth-seekers! Dive into the world of uncensored combat through our Telegram channel. Discover the shocking reality that shapes our global events.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/Hot_Inside

Videos that shocked the internet!

(dydaychig, 31. 1. 2024 20:13)

Hey there! Seeking unfiltered insights? Join our Telegram channel for exclusive, uncensored footage revealing the untold stories. Witness the unvarnished truth behind the scenes.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/Hot_Inside

Shocking footage of battles

(dydaychig, 31. 1. 2024 16:02)

Hey there! In search of the truth? Our channel showcases content that will change your perception of the world. Join us and learn what won’t be shown on TV!

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

UNCENSORED!

(dydaychig, 31. 1. 2024 15:05)

Greetings, eager minds! Seeking unfiltered revelations? Join our Telegram channel for uncensored, raw content challenging mainstream narratives. Explore the unvarnished reality shaping our lives.

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

How to get millions of instant leads for your business

(SamuelOrase, 31. 1. 2024 13:03)Get millions of instant leads for your business to launch your promotion. Utilize the lists an unlimited quantity of times. We have been providing companies and market analysis firms with information since 2012. Mailbanger

Nuovo Step by Step Map per dating

(Jaydencit, 24. 1. 2024 4:25)

I loved as much as you'll receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get bought an shakiness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly very often inside case you shield this hike.

eharmony's advanced compatibility matching system uses a scientific approach to help you find the perfect Compagno. Here's why we chose it: https://serials.monster/user/IngeborgN14/ dating per inesperti

@eerwq

dating Cose da sapere prima di acquistare

(Kaylacit, 24. 1. 2024 3:40)

I like the valuable info you provide in your articles. I'll bookmark your weblog and check again here regularly. I am quite certain I will learn many new stuff right here! Good luck for the next!

With more than 35 million members, per the company, Zoosk features Behavioral Matchmaking technology—which supposedly learns from user activity to create better matches. https://www.cheaperseeker.com/u/cristinabradley dating - Una panoramica

@eerwq

How drones drop explosives on soldiers

(dydaychig, 18. 1. 2024 15:25)

Attention! Dive into the unfiltered world of warfare through our Telegram channel. Witness the shocking truth they don't show on TV. Join us now!

This is unique content that won't be shown on TV.

Link to Channel: HOT INSIDE UNCENSORED

https://t.me/+HgctQg10yXxhMzky

An Unbiased View of Kids Motivation and Learning

(Davidner, 16. 1. 2024 12:56)

“College students trust one another as there isn't a Level of competition to get paid quite possibly the most details and receive the highest quality in the class. Somewhat, pupils rely upon each other's strengths so as to achieve success.”

Ensure that the aim is reasonable and can be carried out in a short time. If you end up picking a longer-time period goal, set milestones along the way in which. Placing an affordable target allows be certain pupils working experience accomplishment, which is able to inspire them to make further more progress.

The reality is none of such youngsters is “unmotivated.” Actually, they’re very inspired — to avoid general public humiliation or failure.

https://studio.youtube.com/channel/UCSMIhWbFVnLChQV4g-wElzA/

Acknowledging a college student’s excellent behaviour in a very learning setting can motivate Some others to abide by fit (Credit history: Alamy)

This curriculum nurtures a constructive college lifestyle and aims to further improve student conduct. Points are attained by learners Conference expectations and will be exchanged for things in a web based retail outlet.

Perhaps check out our article on Trainer burnout to reignite your spark within the classroom. If You're not enjoying oneself, your college students aren’t very likely to either.

<iframe width="560" height="315" src="https://www.youtube.com/embed/1JvFNs2WXjg?si=89IAreyVv3nnW47k" title="YouTube video player" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share" allowfullscreen></iframe>

Two drivers of learning behaviour are organic curiosity and the desire for the reward. But which is better for aiding children learn?

If your Trainer has presently established very clear plans and monitoring strategies, put up them Evidently and have conversations with your son or daughter regarding their progress. You are able to skip right down to the final two bullets in this list.

. The last thing you want to do is hold out right until There may be a problem or challenge with minimal Tommy prior to deciding to try to establish a romance along with his mothers and fathers. At first of yearly, get to out to the mom and dad of each and every child inside your course in a personal way.

Turning each day into a learning working day may possibly audio similar to a bit Considerably, but it really seriously isn’t, should you go over it the right way. Whenever feasible, inspire your child to take a look at the planet all-around him, request thoughts and make connections.

Test incorporating a exhibit-and-explain to prospect the place pupils can Exhibit and speak about objects from all-around their home that are very important to them.

Greatly enhance wellbeing Using these absolutely free, science-centered exercise routines that attract on the latest insights from favourable psychology.

As outlined by gurus, it’s not right up until later which they learn to do anything – like sit quietly in a snack desk – to be able to attain a reward or prevent a punishment.

Dr. Stipek reports on experiments that reveal a child’s beliefs about intelligence have an effect on his motivation to realize success. If he thinks intelligence is preset at start and he missed out, he is liable to Stop devoid of seeking. If, Alternatively, you help him to know that persistence is more essential than the luck in the attract, you endorse a youngster who will figure out how to realize success on his individual terms.

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57

BITCOIN MONEY SEARCH SOFTWARE

(Lamaeving, 2. 2. 2024 13:34)